TRANSACTIONAL LENDING MADE SIMPLE.

Whether you’re a real estate investor or wholesaler, we’ll fund your deals fast- no credit check required. We cover EMD, double closings and even your down payment for a seller carry-back.

158

Deals Completed

$8.1M

FUNDED

117

CUSTOMER TRANSACTIONS WORLDWIDE

127

Deals Completed

$1.9M

FUNDED

58

CUSTOMER TRANSACTIONS WORLDWIDE

So What's It Cost?

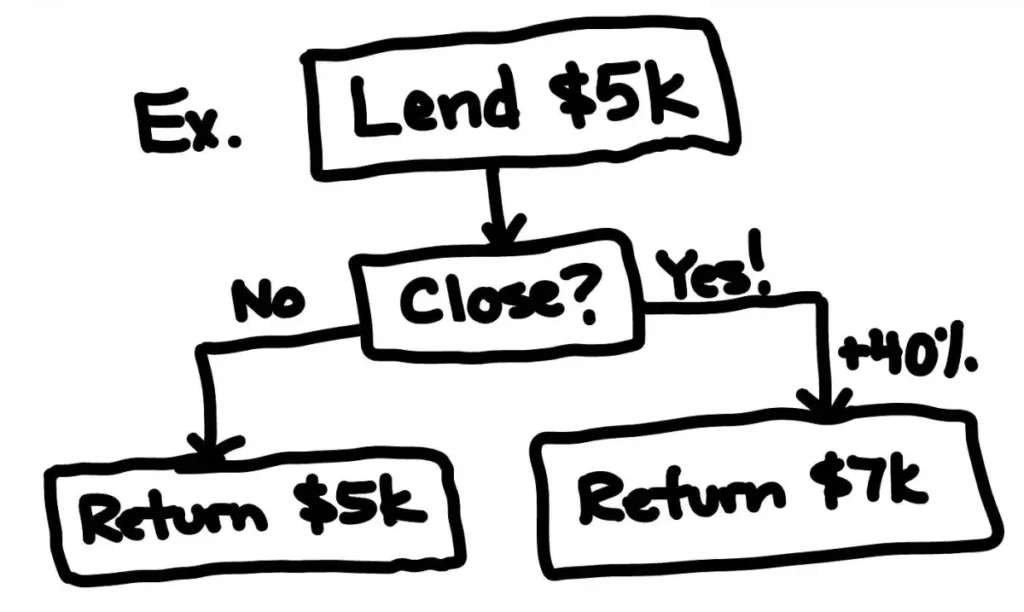

EMD Deals

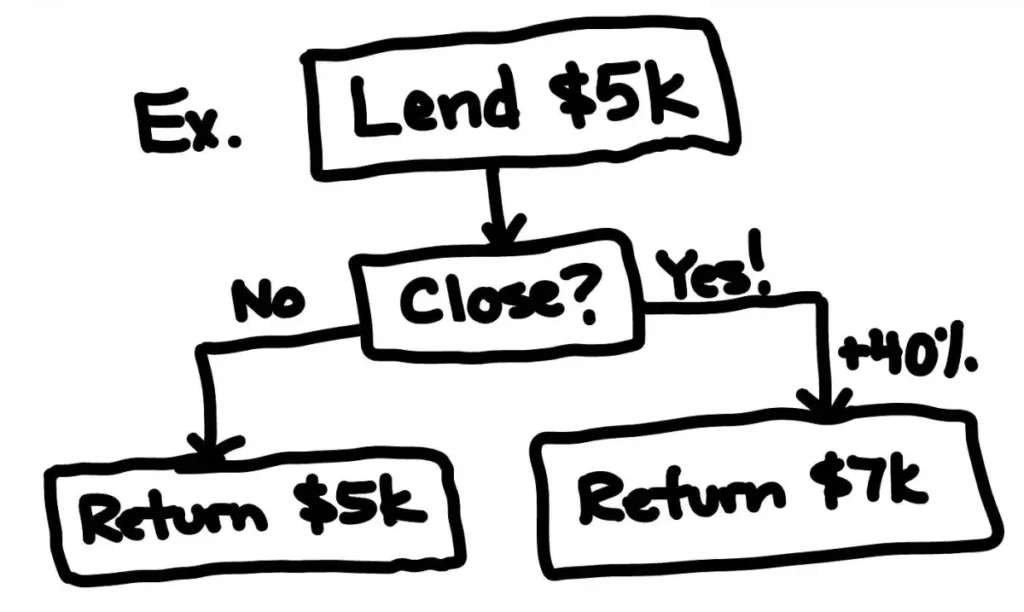

We charge a flat 40% return on all EMD Lending deals with a $2,000 minimum return. That means IF the deal closes, we would receive the initial amount plus 40%. We also charge a minimum $250 non-refundable fee prior to funding your deal to pay our transaction coordinator. This pays them for their time in case the deal doesn’t close.

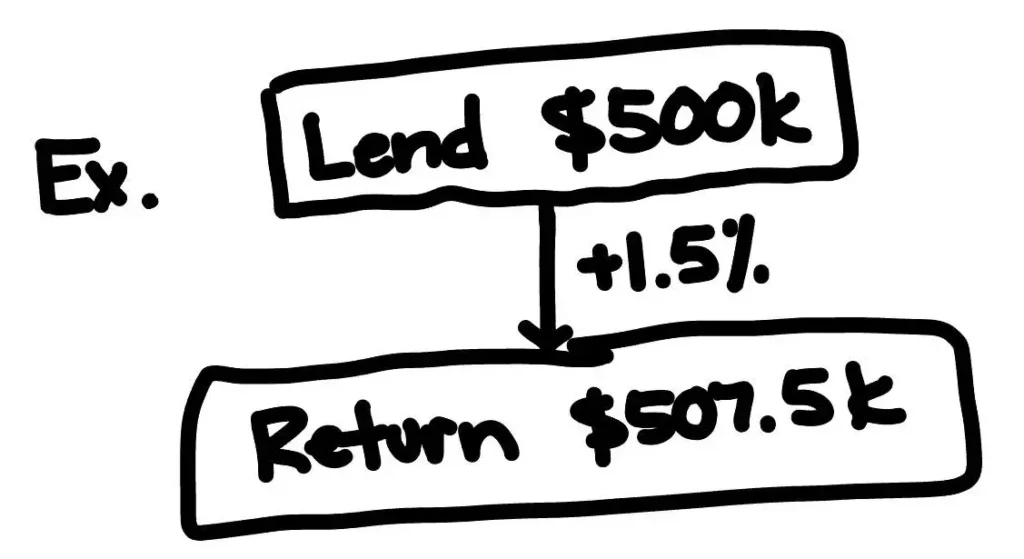

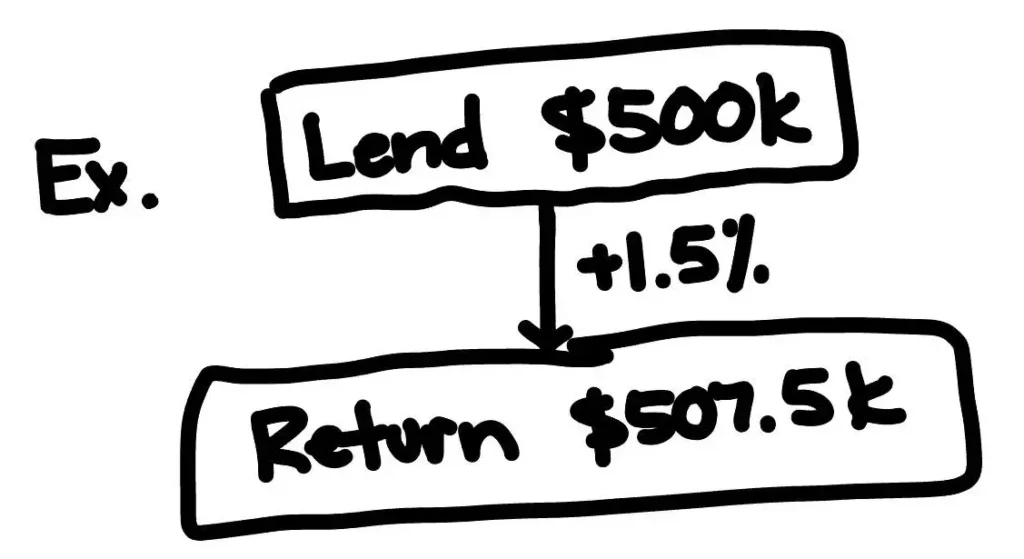

Double Close Funding

We charge a flat 1.5% fee on all double closings with at least 1 weeks notice. If you need the money quicker then we have to review to confirm. Rush funding often comes with a 1% rush fee. Our minimum return is $2,000 on smaller deals.

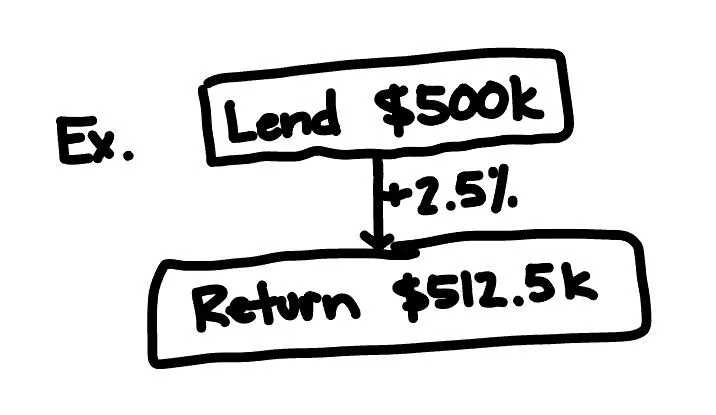

Seller Carryback Funding

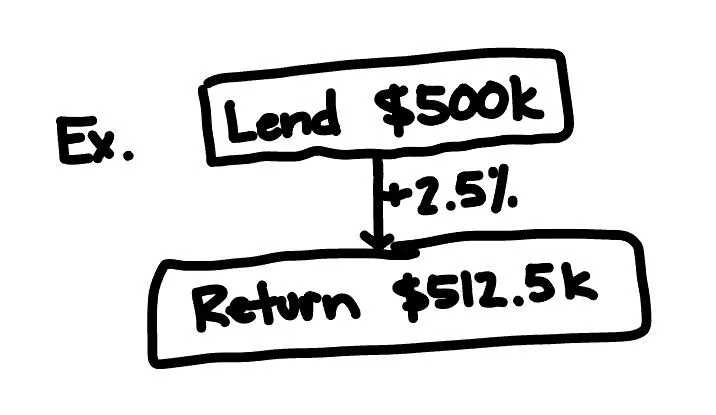

We charge a flat 2.5% minimum fee on seller carry-back deals with at least 1 weeks notice. If you need the money quicker than that we will have to review to confirm. Our minimum return is $2,000 on smaller deals.

So What's It Cost?

EMD Funding

We charge a flat 40% return on all EMD deals with a $2,000 minimum return. That means IF the deal closes, we would receive the initial amount plus 40%. We also charge a minimum $250 non-refundable fee prior to funding your deal to pay our transaction coordinator.

Double Close Funding

We charge a flat 1.5% fee on all double closings with at least 1 weeks notice. If you need the money quicker than that we will have to review to confirm. Our minimum return is $2,000 on smaller deals.

Seller Carryback Funding

We charge a flat 2.5% minimum fee on seller carry-back deals with at least 1 weeks notice. If you need the money quicker than that we will have to review to confirm. Our minimum return is $2,000 on smaller deals.

Transactional Lending FAQs

A double closing is a real estate transaction method where two back-to-back property sales of the same property occur ideally on the same day, involving three parties: the original seller, the investor (middleman), and the end buyer. Here’s how it works:

First Transaction: The investor agrees to purchase the property from the original seller.

Second Transaction: The investor simultaneously sells the property to the end buyer at a higher price.

During a double closing, the investor typically uses the funds from the end buyer to complete the purchase from the original seller. This allows the investor to profit from the difference in sale prices without needing to use their own funds for an extended period.

Double closings are often used in real estate wholesaling and transactional funding, allowing investors to efficiently facilitate deals and earn profits by connecting motivated sellers with interested buyers.

It is a sum of money that a buyer provides to a seller as a show of good faith when entering into a real estate contract. The EMD is typically held in escrow until the closing of the transaction.

When looking at whether or not what you are requesting is considered EMD, you can look at the following:

- Is the amount you’re requesting the exact same as the amount listed for EMD on the contract?

- Does your requesting amount include an option fee? We will not fund those!

- Are you requesting money post-closing? That is not EMD and we will not fund that.

We can fund EMD Lending for end buyers, but it’s rare. At the end of the day, our funds have to be protected no matter what. Typically that is done through an inspection period. If you have no inspection period on your deal or the EMD is non-refundable we will not fund your deal. If however you have an inspection period, we can fund your deal temporarily as long as our funds are replaced prior to the inspection period ending.

If your deal does not close, we do not charge you the 40% fee. Your only cost would be the up front fee since our transaction coordinators have already worked on the deal for you.

There is no limit on the funds we have available for both EMD and double closings. As long as your deal qualifies under our standards, we will be your one stop shop for all transactional funding both now and in the future!

We typically require 48 hours of notice to fund a deal, however we have funded in as quickly as 5 minutes (seriously). If you have a deal, your best bet is to submit it as soon as possible so we can review it and get the process started.

What People Are Saying

Ben Jensen

Wholesaler

"We typically don’t need Oakstone Lending funding on our direct to seller deals, but I had 2 come up that required it and oakstonelending got it done asap!"

Gage Garber

Wholesaler

I’ve worked with many gators, but oakstone is the best.They fund my deals within the hour every time!

Christian Dean

Flipper

"Oakstone Lending was a huge help with closing my deal fast! Sent in a request and they were able to fund my EMD same day!"

Transactional Lender | Why Oakstone Lending Is Your Best Choice for EMD & Double Close Funding

When it comes to real estate deals, speed and reliability are everything. Whether you’re a seasoned wholesaler or just starting in the industry, finding a transactional lender who can move quickly and has the capital to back any size deal is critical. Oakstone Lending stands out as the best choice for EMD and double closing funding because we understand the urgency of your transactions, and we deliver fast, reliable solutions that you can count on.

Experience You Can Trust: 150+ Transactional Lending Deals Closed

At Oakstone Lending, we’ve successfully funded over 150 deals, which means you’re working with a transactional lender who knows the ins and outs of transactional funding. This extensive experience sets us apart from other lenders who might not fully understand the time-sensitive nature of double closings or EMD funding. We’ve been there, we’ve done it, and we’re here to help you close your deals on time, every time.

Quick and Reliable Funding for All Your Transactional Lending Needs

Time is of the essence in real estate transactions. When you need Earnest Money Deposit (EMD) or double closing funding, there’s no room for delays. Our streamlined processes allow you to focus on securing your deal while we take care of the funding quickly. Oakstone Lending has automated systems in place that enable us to approve and fund deals faster than traditional lenders. This means you can close your deals with confidence, knowing you have a reliable funding partner backing you.

Our automated approval process ensures that your application moves through the system without unnecessary delays. The moment you submit a deal, our platform begins working for you—no waiting for someone to manually process paperwork. Whether it’s a $1,000 EMD or a $2 million double closing, Oakstone Lending is ready to move at the speed you need.

Flexible Funding for Deals of Any Size

One of the biggest challenges real estate investors face is finding a lender who can fund deals of any size. Oakstone Lending has the capital to back your transactions, no matter how big or small. Our flexible funding solutions are designed to meet the needs of all wholesalers and real estate investors, whether you’re closing a small deal or a multi-million-dollar transaction.

We don’t just limit our services to small, cookie-cutter deals. Oakstone Lending has built a reputation for being able to fund just about any deal size. With our ample capital reserves, we ensure that your deal won’t fall through due to funding limitations. This flexibility allows you to focus on growing your business, confident that Oakstone Lending will be there to support your deals.

Streamlined Approval for Hassle-Free Closings

Gone are the days of dealing with endless paperwork and multiple back-and-forths with lenders. At Oakstone Lending, we’ve invested in automated processes that streamline the entire approval and funding process. This ensures you can get the capital you need in the shortest time possible, without the hassle of traditional funding methods. Our approach is designed to get you from submission to funding quickly, so you never miss out on an opportunity due to slow or unreliable financing.

Our system works by simplifying the approval process, cutting through red tape, and focusing on the essentials that matter. You submit the deal, and we get it funded—no hidden fees, no complicated terms, just fast, reliable funding when you need it most.

The Oakstone Transactional Lending Advantage

There are many transactional lenders out there, but what makes Oakstone Lending stand out? Here are just a few of the reasons why we’re the preferred choice for EMD and double closing funding:

- Proven Experience: With over 150 deals successfully closed, we’ve seen it all. You can trust us to handle your deal professionally and efficiently.

- Speed & Efficiency: Our automated processes mean that you won’t be left waiting around. Submit your deal, and we’ll work quickly to get it approved and funded.

- Plenty of Capital: We have the financial resources to back your deals, whether you need $1,000 or $2 million. No deal is too big or too small for Oakstone Lending.

- Reliability: Real estate deals move fast, and you need a lender who can keep up. We pride ourselves on being dependable, with a track record to prove it.

- Simple Process: Our approach is straightforward. Submit your deal, and we handle the rest. No unnecessary complications or delays—just fast funding.

- Dedicated Support: While we rely on automation to speed things up, our team is always here to help. If you have questions or need guidance, we’re just a call or click away.

What Is Transactional Lending?

For those who may not be familiar with the term, transactional funding is a short-term loan used in real estate transactions, specifically for double closings. It allows you to secure the property in one transaction and sell it to the end buyer in a second transaction on the same day, using the buyer’s funds to pay back the loan.

This type of funding is essential for wholesalers who need to close quickly and don’t want to use their own money for the deal. It allows you to maintain liquidity while securing profitable deals with minimal risk.

What Is EMD Funding?

Earnest Money Deposit (EMD) funding is another crucial service we offer. When you make an offer on a property, the seller typically requires a deposit to show that you’re serious about purchasing. This deposit is known as the EMD. If you’re a wholesaler looking to secure multiple deals, having quick access to EMD funding can make all the difference.

Oakstone Lending specializes in providing fast, reliable EMD funding so you can move forward with confidence. Our streamlined processes ensure that your EMD is funded quickly, allowing you to secure the property without unnecessary delays.

Why Speed Matters in EMD and Double Closings

At Oakstone Lending, we’ve successfully funded over 150 deals, which means you’re working with a transactional lender who knows the ins and outs of transactional funding. This extensive experience sets us apart from other lenders who might not fully understand the time-sensitive nature of double closings or EMD funding. We’ve been there, we’ve done it, and we’re here to help you close your deals on time, every time. You can trust us as your transactional lending partner of choice along with our strategic partners at swiftemd.com.

Partner with Oakstone Lending for Your Next Deal

At Oakstone Lending, we’re more than just a transactional lender—we’re your trusted partner in real estate. Our mission is to provide fast, flexible, and reliable transactional lending services for EMD and double closings so you can focus on growing your business. With over 150 successful deals funded, automated processes for speed and efficiency, and the capital to back any size deal, Oakstone Lending is the best choice for your transactional funding needs. Contact us today to submit your deal and experience the Oakstone Lending advantage.