If you’re wholesaling or flipping land, you know that speed and flexibility are everything. But what happens when you need to buy the property first before selling it to your end buyer? That’s where double closing funding for advanced land wholesalers like you comes in.

Double closings let you buy and sell a property on the same day, keeping your profit margin private while avoiding contract assignment restrictions. However, without the right funding, pulling off a double closing can be tough. Oakstone Lending offers fast, short-term double closing loans, so you can secure your deals without using your own cash.

What is Double Closing Funding?

Double closing funding (also called transactional funding) is a short-term loan that gives wholesalers and flippers the capital to purchase a property from the seller and immediately sell it to an end buyer.

Here’s how it works:

- You put the property under contract with the seller.

- You secure an end buyer who agrees to buy the property at a higher price.

- Oakstone Lending funds your purchase so you can close the first transaction.

- You immediately sell the property to the end buyer, repaying the loan and keeping the profit.

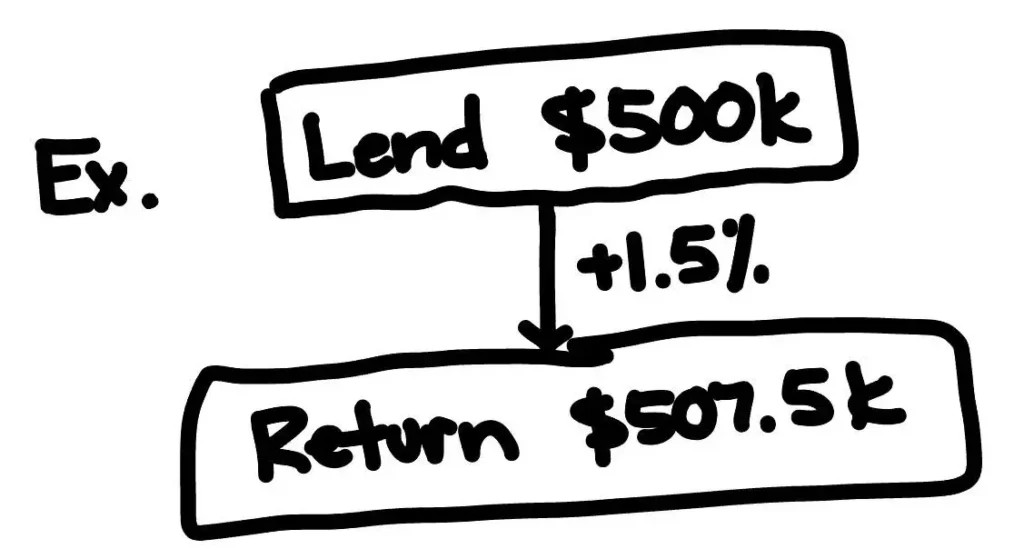

Since these transactions happen back-to-back (often within hours), no credit checks or long-term financing are needed. Our double closing funding comes with a flat 1.5% fee and requires at least one week’s noticeTransactional Lending C….

When Should You Use Double Closing Funding?

Double closing funding is a game-changer for land wholesalers in situations like these:

🚫 Non-Assignable Contracts – Some contracts (like bank-owned properties or MLS listings) can’t be assigned. Double closing lets you buy the property yourself and resell it immediately.

🤐 Keeping Profits Confidential – Some end buyers back out if they see you making a big wholesale fee. With a double closing, your earnings stay private.

⏳ Fast-Moving Deals – Need to close quickly? Double closing funding lets you secure the deal without waiting on your buyer’s financing.

🏚️ Distressed Properties – Sellers with distressed land may need to sell ASAP. With double closing, you can move fast and still find the right buyer.

📜 Avoiding Wholesaling Regulations – Some states restrict contract assignments. Double closing helps you stay compliant while flipping land legally.

The Pros & Cons of Double Closing

✅ Benefits of Double Closing Funding

✔ Fast Access to Capital – No waiting on lenders or mortgages. Get funding in days.

✔ Keep Your Profits Private – Your end buyer won’t see what you paid for the land.

✔ More Deal Opportunities – Buy properties that aren’t assignable, like MLS or bank-owned deals.

✔ Stronger Seller Confidence – Sellers prefer buyers who can close with certainty.

✔ No Credit Checks or Personal Risk – The loan is secured by the deal, not your credit score.

⚠️ Drawbacks of Double Closing

❌ Higher Costs – Since there are two transactions, you pay closing costs twice.

❌ More Moving Parts – You need both deals (your purchase & your sale) to close smoothly.

❌ Potential Delays – If your buyer backs out last-minute, you could be stuck with the property.

How Double Closing Funding Works with Oakstone Lending

Oakstone Lending makes double closings fast and easy. Here’s how to get funded:

Step 1: Submit Your Deal

- Send us your purchase contract and end buyer contract.

- We review your deal and provide same-day approvals.

Step 2: Get Funded

- We fund 100% of your purchase price (no upfront money needed).

- Your loan fee is just 1.5%, with a $2,000 minimum returnTransactional Lending C….

Step 3: Close & Get Paid

- You buy the land from the seller and sell it to your end buyer on the same day.

- Oakstone Lending gets repaid from your sale proceeds, and you keep the profit.

💰 Example Deal:

- Buy Price: $500,000

- Sell Price: $600,000

- Oakstone Lending Funds: $500,000

- Loan Fee (1.5%): $7,500

- Your Profit: $92,500 🚀

How to Maximize Profits with Double Closing Funding

Want to get the most out of your double closings? Follow these tips:

✔ Line Up Your Buyer First – Never start a double closing without a solid buyer in place.

✔ Negotiate a Lower Purchase Price – The lower you buy, the more you profit.

✔ Use a Title Company Experienced in Double Closings – Not all title companies handle these deals. Work with one that understands the process.

✔ Act Fast – Sellers love fast closings, and a double closing lets you secure deals others can’t.

✔ Know Your Market – Make sure you’re flipping land in high-demand areas with strong resale potential.

Other Ways to Fund a Double Closing

If double closing funding isn’t the right fit, here are some alternatives:

💸 Hard Money Loans – Higher interest rates but longer terms.

🤝 JV Partnerships – Partner with an investor who funds the deal for a split of the profit.

🏦 Private Lenders – Flexible terms but requires strong connections.

📜 Seller Financing – Negotiate terms directly with the seller instead of using a lender.

Get Your Double Closing Funded Today!

If you’re a land wholesaler or flipper looking for fast, reliable double closing funding, Oakstone Lending is ready to help.

📌 Why Work With Us?

✔ 1.5% flat fee (minimum $2,000 return)

✔ No credit checks or long applications

✔ Fast approvals & same-day closings

✔ Experienced transactional funding team

📢 Ready to close more deals? Submit your deal now at OakstoneLending.com and get funded fast!